For those unfamiliar with the term, real-time payments (RTP) are transactions processed and settled within seconds, available 24/7/365. RTP offers several advantages over traditional payments, such as:

• Speed: RTP transactions are processed and settled much faster than traditional payments, which can take days or even weeks.

• Convenience: RTP transactions can be initiated from anywhere, at any time, and on any day of the week.

• Security: RTP transactions employ end-to-end encryption, making them more secure than traditional payments.

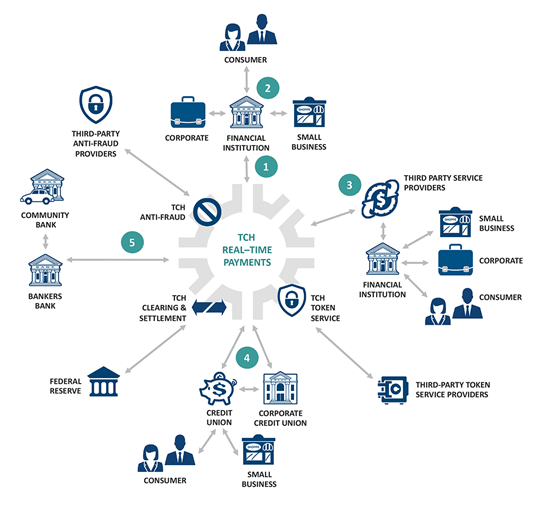

In recent years, the United States has witnessed growing interest in RTP, even though it lags significantly behind other developed and developing countries in this regard. In 2017, The Clearing House launched its RTP network, now utilized by over 65% of U.S. financial institutions. Additionally, the Federal Reserve plans to launch its own RTP network, FedNow, in 2023.

Factors Driving RTP Growth

Several factors are driving the growth of RTP in the U.S., including:

• The rise of mobile payments: With mobile payments becoming increasingly popular, RTP is well-positioned to cater to this growing market.

• The growth of P2P and P2M platforms: Platforms like Venmo, Cash App, Apple Pay, and Zelle have experienced massive adoption and enjoy significant popularity among consumers and micro-businesses. However, fraud, scams and lack of liability from banks and e-wallets remain growing concerns.

• The expansion of e-commerce: As e-commerce continues to grow rapidly, RTP can streamline transactions by making payments faster and more secure.

• The demand for faster payments: Businesses and consumers increasingly require faster, more affordable payment options for larger amounts as wire transfers are expensive, slow and inefficient, so RTP can help meet this demand.

Benefits of RTP Growth for the U.S.

The expansion of RTP is anticipated to yield several benefits for the United States, including:

• Increased economic activity: RTP can boost economic activity by facilitating quicker and more efficient transactions between businesses.

• Improved financial inclusion: RTP can enhance financial inclusion by making it easier for unbanked individuals to make and receive payments.

• Reduced fraud: The use of end-to-end encryption in RTP transactions can help protect against fraud.

Risks for Card Networks

RTPs pose a potential risk to card networks by disintermediating their services. Card networks generate revenue by charging fees for each transaction. If consumers and businesses transition to RTPs, reliance on credit or debit cards may wane, leading to a substantial decline in card network revenue.

To mitigate this risk, card networks are investing in RTPs. For instance, Visa has introduced its own real-time payment system, Visa Direct, while Mastercard is developing a similar system.

While it’s too early to predict whether RTPs will disintermediate card networks entirely, their emergence undoubtedly threatens the traditional four-party model. Card networks must adapt to this new technology to remain competitive.

Upcoming RTP Network Launches

Several upcoming RTP network launches are planned in the U.S. including those from fintechs, P2P players card networks, such as:

• FedNow: The Federal Reserve is set to launch its RTP network, FedNow, in 2023. This nationwide network will enable banks and financial institutions to send and receive RTP transactions.

• The Clearing House RTP network expansion: The Clearing House plans to extend its RTP network to include additional financial institutions by 2023.

• The Zelle Network: Zelle, a P2P payments network owned by a consortium of banks, aims to launch an RTP network in 2023, currently in pilot program with a small group of banks and financial institutions.

Other RTP Related Developments

• Fintech Plaid Launches RTP API: Plaid, a fintech that provides payment infrastructure, has launched an RTP API. The API will allow banks and financial institutions to integrate RTP into their existing payment systems.

• Mastercard Launches RTP Service for U.S. Merchants: Mastercard has launched an RTP service for U.S. merchants. The service will allow merchants to accept RTP payments from their customers.

• Visa launches Visa+: A new service that will bring interoperability to different P2P services without the need of a Visa card. Initially, it will only be available to Venmo and PayPal users but additional services will be added in the future.

Conclusion

The landscape of RTP in America is rapidly evolving, driven by factors such as the rise of mobile payments, the expansion of e-commerce, and the demand for faster transactions. Several upcoming RTP network launches are also planned in the U.S. The growth of RTP is expected to benefit the country through increased economic activity, improved financial inclusion, and reduced fraud.

Finally, given the size and fragmented nature of the U.S. financial system, and the number of competing entities, there may never be one cohesive real-time payments network standard like in other countries. The key will be having interoperability between all these competing networks.

Leave a comment